For Rev. Tommy Odum, the most rewarding aspect of serving as lead pastor at Centerville UMC* in Centerville is the opportunity to work with the people.

“They are extremely loving and caring and also have an incredible heart for outreach. We have a Food Pantry that has quadrupled in a year, and our Clothes Closet ministers to people in need every Tuesday,” Odum said. “They are wonderful givers of their time, energy, effort, and finances. They understand the mission of the church and meet our community where they are.”

Odum holds a bachelor of science degree in organizational leadership, which has proven invaluable in leading Centerville UMC. Since his appointment in June 2020, he has worked closely with the church’s administrative team to improve its financial health. Odum shares several strategies, including a loan refinance with the Georgia United Methodist Foundation (the Foundation), that has put Centerville UMC in tip-top financial shape.

Move Beyond the 80/20 Rule

What is the 80/20 rule, and why do congregations need to move beyond it? “The 80/20 rule says that 20% of the people in your congregation are doing 80% of the work. That could include in your giving. When you have two people giving a huge portion of your budget, and when you lose those people, it impacts the budget in a powerful way, not only in paying salaries but also with missions and programs,” Odum said. “Our church is closer to 70/30. Our average attendance is 150 people, and we have over 100 giving units. So, it’s people who give consistently to the church.”

Age of Your Church Members Matters

Odum encourages churches to know the average age of their members. “The average age of our congregation is roughly 65 to 70, and the average mortality rate in the U.S. is about 75 to 78. That means that we will have a significant decline in our congregation in five to eight years because of death and that we have five to eight years to change the face of our congregation in a way that improves our finances. You must look at how your finances are impacted over time with your death rate, and then determine how to compensate for growth within your church,” Odum said. “The best way to offset this is to bring in young families and young adults. Since young families and young adults give half as much as we need, we need to bring in twice as many. They have a harder time giving because they may have a car payment, mortgage, and daycare costs.”

Make Your Older Adults Feel Valued

“Our older members are extremely important because they gave us the legacy to build on at the church,” Odum said. “We try to be there when they are in need, sick, or in the hospital. We also try to minister to these members through our preaching and by developing messages they haven’t heard before.”

Reduce Expenses

After analyzing the data on people and how death rates impact the church and considering what steps Centerville UMC needed to take to grow, Odum looked for ways to reduce expenses.

“You have to consider the financial implications of the decisions you make today and then make changes to positively impact the church,” he said. “Employees are the last area you want to cut. People make the church grow – not the copier. So, we renegotiated the copier and cleaning contracts and saved over $6,000 per year.”

Refinance Your Mortgage

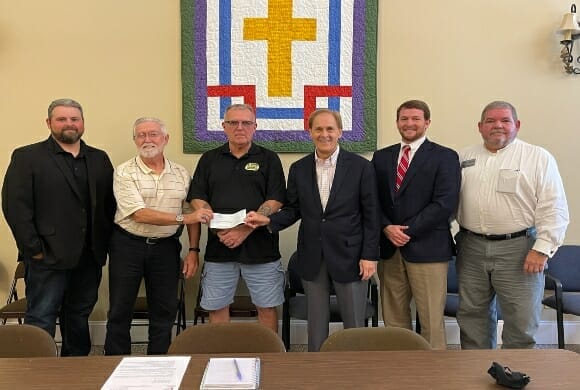

Odum also looked at the church’s mortgage expenses and began shopping loan rates to refinance its loan. Dr. Rick Lanford, Foundation Regional Vice President, connected Odum with Jim Pope, Foundation Senior Advisor to the President and Director of Lending.

“Jim reviewed our current mortgage and financial records and then sent a proposal. Working with the Methodist Foundation was a no-brainer. We received a lower interest rate and lower mortgage payment, saving us over $2,000 per month. In addition, unlike our former lender, the Foundation does not have balloon maturities, which would require the church to pay additional fees to refinance the loan. Conservatively speaking, we’re saving about $150,000 over five years,” Odum said. “When you can save this significant amount of money, you are providing opportunities to fund programs and ministries that will achieve the goal of lowering the average age of the church and bringing in young families and young adults.”

Odum found Jim to be a great resource. “We had a small crisis while refinancing the mortgage. Multiple air conditioners needed to be replaced, and we had some other expenses come up at the same time. I asked Jim if we could increase the loan to cover the additional costs. He called back within an hour and said we were able to add to the mortgage. We now had money to take care of our building and facility,” Odum said. “The Foundation worked hard for us and set us up for the success of our church financially in the future. Our church is in the best financial position we have been in for the past 10 years.”

*In 2023, Centerville UMC because The Well at Centerville where Rev. Tommy Odum continues to serve as lead pastor.